ACCA Vs CMA US: Which Suits You Better? | Uplift Professionals

ACCA stands for Association of Certified Chartered Accountant is a Chartered Accountant degree which is given by Association of Chartered Accountant with headquarters situated in London. The role of work is related to inspection of accounting services to the public, private entities. CMA stands for Certified Management Accountant and the degree is provided by the Institute of Management Accountants (IMA), USA. The field of work is related to management accounting services with strategic financial management decision making and planning for the companies like small and mid-size firms and MNCs including the big 4s. If the pertinent question arises which course, are you planning to do further, ACCA certification or CMA US exam? Will you be aiming to do both in the future? If you are confused about your plans just have a look in this article.

What is ACCA?

The ACCA or the Association of Chartered Certified Accountants is a body that recognizes the qualification of a CA. ACCA is a global body based in Glasgow UK which works in the interest of the public to ensure that the chartered accountants work according to the principles-based and ensures that the regulations set are properly followed. The ACCA offers the certification in chartered accountancy and the exam known as ACCA is most recognized in the commonwealth countries. The degree was given with the intention to give protection. The ACCA Exam consists of 14 papers and emphasis is given on the core values of integrity, accountability, diversity, and innovations, etc. The degree is accepted globally across 180 countries. The degree has its own reputation of one hundred years and the professionals have provided services to more than 7500 employers across a different field. The 3 important steps of ACCA are applied knowledge (Diploma), Applied Skills (Advance Diploma) and essentials. Both ACCA vs CPA are highly qualified accounting courses designed for professionals who are interested in making a career in Accounting, Taxation, Auditing, and Finance.

What is CMA US?

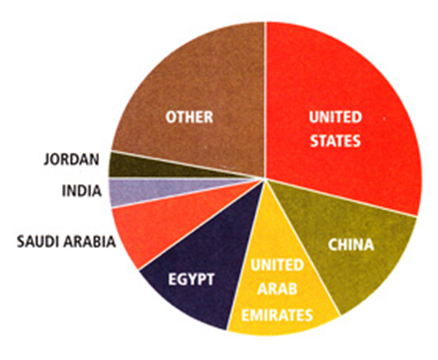

The US CMA course or certification is offered by IMA® (Institute of Management Accountants) of USA, which is the worldwide association of accountants and financial professionals in business. It was founded in 1919, having 90,000+ members and global reach of 140 countries through 300 professional and student chapters. CMA® (Certified Management Accountant) certification has been the global benchmark for management accountants and financial professionals.

You can now get a professional certification from the USA within 12 – 18 months. The CMA certification is well recognized by all the MNCs, Big 4 audit firms, US Banks, Consulting firms and other BFSI companies having offices in India. This certification from IMA® (Institute of Management Accountants) is on par with the Indian CMA by most employers. CMA certified professionals are observed to get a career and earnings premium. In the US, median total compensation is 28% higher for CMAs over non certified peers. Globally, it is 50% higher. The US CMA certification is more attentively focused in the area of management and cost accounting.

A CMA certification aspirant is more likely to investigate, analyze, risk management and performance management and can work in various capacities ranging from financial analyst to CFO, and very often necessitate formulating major financial decisions for an organization. CMA US is a 2-part online exam where graduation is the academic criterion to take the exam. With dedicated study and quality assistance, the 2-part exam can be cleared in approx. 9 months on average.

CMA US vs ACCA: Application & Qualification

The most significant differences between ACCA and CMA are in the qualifications and the application processes.

CMA US

Steps To Become A CMA USA:

1. Foundational knowledge of economics, basic statistics, and financial accounting

2. Pass both CMA exam parts

3. Bachelor’s degree from an accredited college or university

4. Any major, no course distribution requirements

5. Most CMA candidates hold a degree in accounting or finance

6. May be earned within 7 years of passing CMA exam parts

7. Two years of professional work experience

8. May be fulfilled within 7 years of passing CMA exam parts

9. Active membership in IMA

Requirements to maintain CMA certification:

1. 30 hours of CPE annually

2. CPE must include 2 hours of ethics training

3. Maintain active IMA membership

ACCA

The ACCA entry level is much lower than the CMA. Plus, the ACCA has two entry points depending on your education and experience. The ACCA labels these levels as “ACCA Foundations in Accountancy” and the “ACCA Qualification” level. The foundation level is for people who are new to accountancy and do not have an education threshold. It is also the best place to start for people working in finance but who don’t have adequate education levels or qualifications to apply for higher-level positions.

The exams at the Foundations level test your understanding of basic accounting principles. Basically, the ACCA feels that you should have mastered these topics before going for the ACCA Qualification exams. If you have more experience and/or education, you can start at the ACCA Qualification level. The ACCA’s exact requirements state that you can begin at this level “as long as you have 3 GCSEs and 2 A Levels in 5 separate subjects including Maths and English.” Basically, this means you need a bachelor’s or master’s degree.

However, if you only have a high school diploma, you can begin the ACCA Qualification exams if you pass the ACCA Advanced Placement Examination. This test analyses your proficiency in the material that appears in the ACCA Foundations of Accountancy program. In addition to passing all papers for the ACCA Qualification, candidates must also take the Ethics and Professional Skills module. Additionally, they need to gain 3 years of appropriate work experience before calling themselves ACCA-certified.

ACCA versus CMA US: Exam Content and Format

ACCA

The ACCA Qualification has several smaller exams to pass, called “papers.” The ACCA exam is divided into 13 papers as follows:

Applied Knowledge:

- Accountant in Business

- Management Accounting

- Financial Accounting

Applied Skills:

- Corporate and Business Law

- Performance Management

- Taxation

- Financial Reporting

- Audit and Assurance

- Financial Management

- Strategic Professional – Essentials

- Strategic Business Leader

- Strategic Business Reporting

Strategic Professional – Options (complete 2):

- Advanced Financial Management

- Advanced Performance Management

- Advanced Taxation

- Advanced Audit and Assurance

Candidates can apply to waive some papers based on their education levels. Or, they can take the “Certified Accounting Technician Qualification” assessment to waive some papers according to practical experience. However, please note that you can only receive a maximum of nine exemptions for the Applied Knowledge and Applied Skills papers. Plus, you cannot receive any exemptions for the Strategic Professional portions. So, all candidates must sit for those papers. If you think you might qualify for any exemptions, you can use this tool from ACCA Global to find out. Some—but not all—papers are computerized. Furthermore, the exam is offered four times a year at more than 500 testing centers worldwide.

CMA US

The IMA breaks it down like this:

Part 1: Financial Planning, Performance, and Analytics

15% External Financial Reporting Decisions

20% Planning, Budgeting, and Forecasting

20% Performance Management

15% Cost Management

15% Internal Controls

15% Technology and Analytics

Many candidates find Part 1 to be more difficult since it covers more topics and a wider array of subject matter. You can read more about CMA Exam Part 2 difficulty compared to Part 1 if you want to learn more. In general, Part 2 has fewer subjects and units, so many people do consider it easier. Personally, I was more frustrated with Part 2. It seems easier when you look at it, but the questions were not as straightforward as Part 1.

Part 2: Strategic Financial Management

20% Financial Statement Analysis

20% Corporate Finance

25% Decision Analysis

10% Risk Management

10% Investment Decisions

15% Professional Ethics

You will have an average of 12-18 months to complete each part, with 3 years to complete both. Many people sit for the exams in order, taking Part 1 first since it seems the most logical. However, some people think Part 2 will be easier for them, so they register to take it first and get it out of the way. The choice is yours. If you want to review the material a bit more and then decide, that is one option.

- Each exam part is four hours in length

- 100 multiple choice questions, followed by two 30-minute essay scenarios

- Exam administered at Prometric testing facilities across India

ACCA Vs CMA US: How Much Time You Need To Pass?

ACCA

Given the number of papers to pass, candidates generally need 3 to 4 years to complete all papers and become ACCA members. Candidates can sit for the papers during four exam sessions held each year. However, candidates can only take four exams per session and a max of eight papers in a year. So, in theory, you could pass all papers in 2 years. But because of logistics issues, most need 3-4 years. Plus, candidates need 3 years of work experience before receiving their ACCA credentials.

CMA US

Most candidates aim to pass the CMA exam within 6 to 9 months. Both the exam parts are independent, so one can take either the 1st or 2nd part as per will. After all, once candidates pass the first of their 2 CMA Exam sections, they must pass the other one within 3 years of registration with the IMA.

CMA US vs ACCA: Which is Easier?

What test is tougher – ACCA or CMA US? Honestly, that depends on what you consider to be tough. Is ACCA harder than the CMA? In some ways, yes. But in other ways, no. Deciding which one is tough – US CMA or ACCA – there are several factors to consider. First, the US CMA has fewer sections (2 exam sections vs 13 papers for the ACCA Qualification). However, the pass rate of both hovers around 50-55% on average.

ACCA Program vs CMA: Summary

ACCA

- Recognized in UK and commonwealth countries

- Low entry barrier: post-secondary education needed

- Exam only offered 4 times a year

- 500+ testing centers across the globe

- 13 papers

- 3-4 years to complete

CMA US

- Recognized in the US and anywhere with US regional offices

- Recognized in about 144 countries globally including India

- Middle entry barrier: Graduation

- Exams offered in 4 windows annually

- Maximum 1-2 years to complete

- Exam sites in the US + multiple other countries including India

Summing up, Coming to that inherent question, ACCA vs CMA US… Which One Should I opt for? the US CMA is arguably the easier having less duration and being considered as a prestigious management accounting qualification. The CMA US Exam itself has fewer parts than the ACCA — only 2 exam parts compared to 14 papers for the ACCA. Comparatively, CMA US has wider acceptance globally while ACCA is although globally recognized, it is not as highly regarded outside the UK and Commonwealth countries. Cost wise, US CMA is cheaper than pursuing ACCA course.

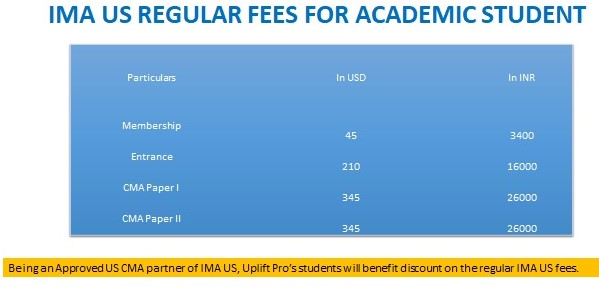

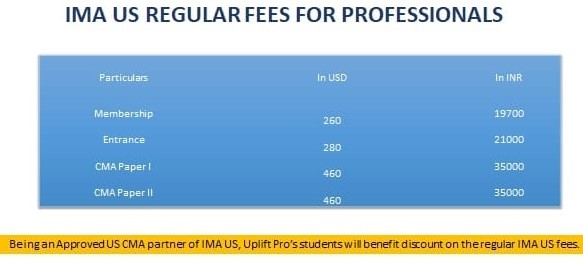

Furthermore, in CMA US, for college students IMA has provision to offer scholarship which allow complete waiver in all IMA fees. If you want to work in the auditing domain relying on IFRS system, you can opt for ACCA but if your inclination is towards management accounting and want to a part of financial decision-making strategic business development, thus, want a job in MNCs on US GAAP system, US CMA should be your cup of tea.

Salient Features of the US CMA Course:

The US CMA course is a worldwide demanded qualification in Finance.

The US CMA course has just 2 parts.

US CMA exams can be cleared in 7 to 9 months’ time.

Exams are conducted online at the prometric centers.

Typically, the US CMA exams have 75% of the questions as MCQs (objective type) and the rest are Essay questions.

Pass percentage of US CMA courses is globally near-about 50%, Uplift Pro has a pass percentage of more than 70%. We are one the smartest US CMA institutes in India.

Along with providing CMA Study Support, we uplift the soft skills of our students, if required, and help them in getting placed in leading companies in and outside India.

The US CMA course helps professionals to build a career across the globe.

Uplift Pro is a valued CMA study center recognized by the IMA US and Gleim Accounting for training students for the US CMA course. Students of Uplift Pro enjoy special discounts in IMA fees.

A US CMA is respected worldwide to be the decision maker in the industry and formulate robust finance and accounting strategies.

Uplift Pro’s US CMA live online classes are scheduled and designed in such a way you can avail them from your home computer after your regular working hours.

Uplift Pro provides a “Till you pass” guarantee to every student which means once you become our student you may attend our live online classes at no extra cost until you pass.

In case you miss a class, you get the recording of it the very next morning.

You get 1:1 personal support from our experienced CMA certified faculties in class and out of the class in dedicated WhatsApp study groups.

For Further Information/Assistance, contact: