An Enrolled Agent (EA) Definition: Who is an Enrolled Agent?

An enrolled agent (EA) is a person who has earned the privilege of representing taxpayers before the Internal Revenue Service (IRS) by either passing a three-part comprehensive IRS test covering individual or business tax returns, or through experience as a former IRS employee.

Eligibility: How can you become an Enrolled Agent?

The IRS does not require any specific educational background to become an enrolled agent. A graduate holding basic accounting knowledge is eligible to apply for the exam but an applicant has to pass each section of the three-part exam and undergo a background check. This can happen in either of the two ways mentioned below:

Clear the 3-part IRS Exam:

-

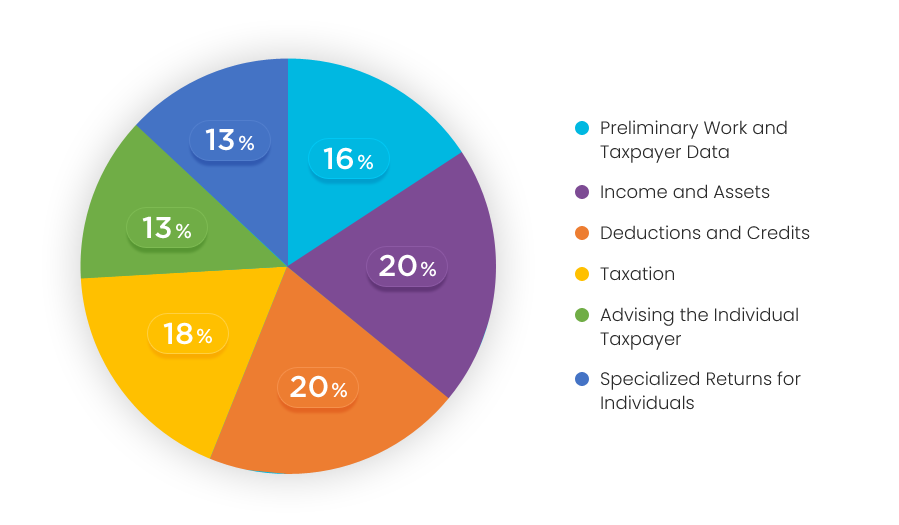

Part - 1: Individuals

-

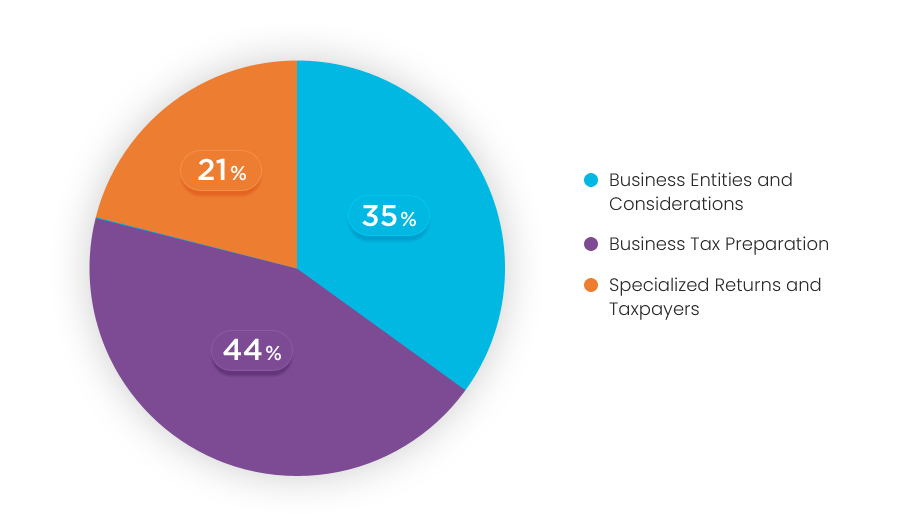

Part - 2: Businesses

-

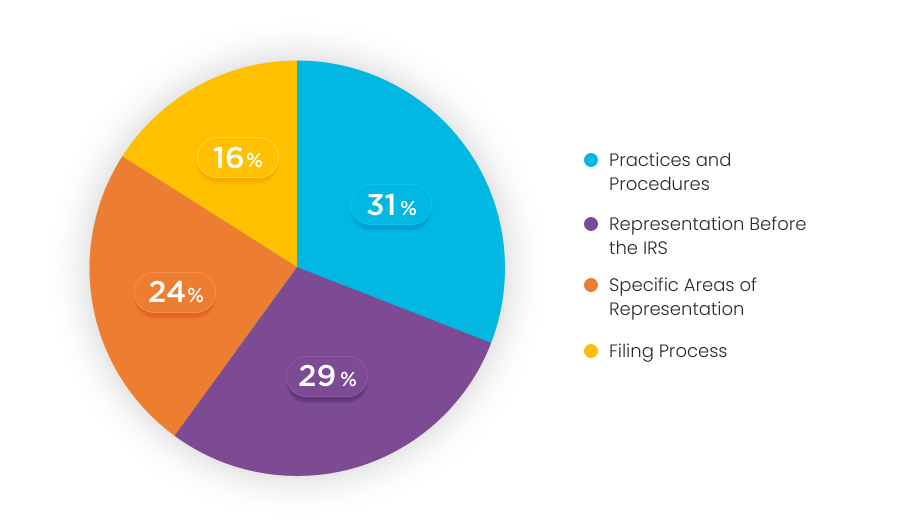

Part - 3: Representation, Practices and Procedures

IRS Experience:

Candidates must hold work experience at the IRS for five consecutive years in a position that regularly engages in applying and interpreting the provisions of the Internal Revenue Code and the regulations.