What is ACCA

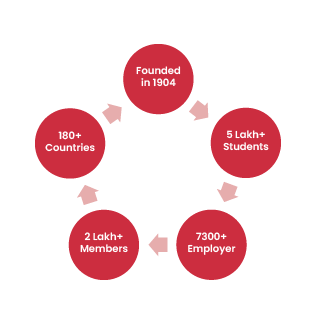

The Association of Chartered Certified Accountants (ACCA) Institute, established in 1904, is the global professional accounting body offering the ACCA qualification, which allows individuals to become professional accountants. The ACCA Qualification is the world leading accountancy qualification for aspiring financial professionals - providing students with the skills, knowledge and values to have successful careers and lead the organizations they work with into the future. As a globally recognized course and updated/Industry relevant content, ACCA qualification is a great way to build a career in Accounts and finance. Students can pursue this along with their graduation. Its flexible examination scheme makes this qualification more attractive. ACCA is a globally-recognized accounting qualification that provides a strong foundation to students and professionals for careers in Accounting, Tax Consulting, Auditing, Business Valuation, Treasury Management, etc.