Certified Public Accountant, USA (CPA US) is one of the most coveted and sought after courses in accounting and finance in a global perspective. For a budding accountant or a finance professional, CPA helps to boost the career in a more colorful manner. It has two parts: CPA exam and CPA license. While passing the CPA US exam can help one to get a job the CPA license gives the right to practice independently. Being an US driven international course, it often raises the question whether a non-US rather than an Indian student can get access to pursue the CPA US course from their own region or not. Answer to this question is highly affirmative. However, Indian candidates must follow the guided path to achieve the CPA US credential they dream of. Let us discuss.

Check your academic eligibility first

- Make sure you have 120 credit points in the commerce stream. In the Indian graduation system of 3 years, 30 points are allocated for each year. Thus, a B. Com got 90 points. To make it eligible, you need to have either a post-graduation or MBA or a member of the ICAI/ICWA.

- There is an exception. A 3-year B. Com graduate can obtain the required 120 points, if he or she obtains a First class/division from a NAAC ‘A’ accredited university.

- It has to be noted that the US federal structure has 55 states having their own CPA board and criteria. Although the majority of the states follow these 120 credit norms, there are certain states which require 150 points instead. The same 150 credit norms are universally required to get a CPA US license.

The two CPA Bodies who govern the CPA US certificate

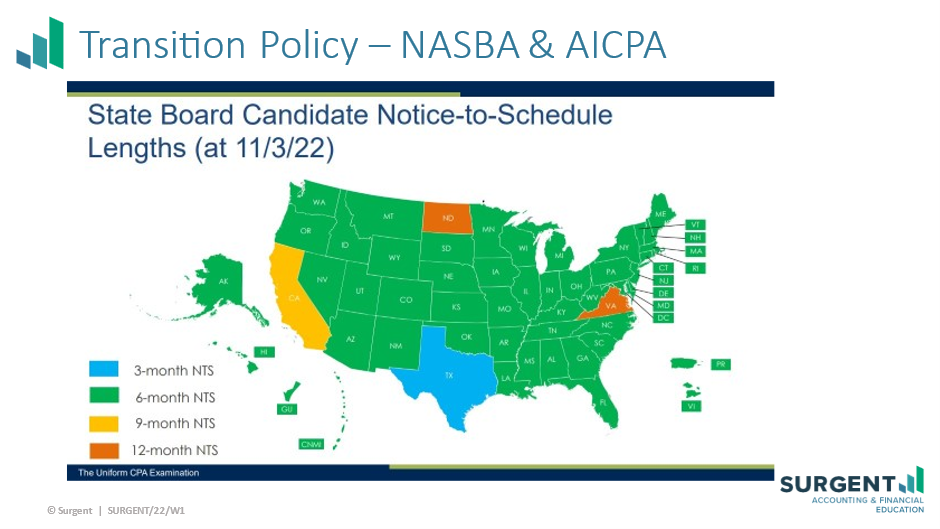

- AICPA-The American Institute of Certified Public Accountants (AICPA) conducts the CPA US examination.

- NASBA-The National Association of State Boards of Accountancy (NASBA) is the highest body of all state boards which guides the administrative pathway by different state boards in the CPA US journey.

How to Apply for CPA US?

- Apply for transcripts from your respective university.

- Send the transcripts to NASBA or any other specified agency for evaluation.

- Upon successful evaluation, the candidate will receive the written confirmation of eligibility for the US CPA exam.

- Select your state board jurisdiction that suits you.

The CPA US Exam Procedure

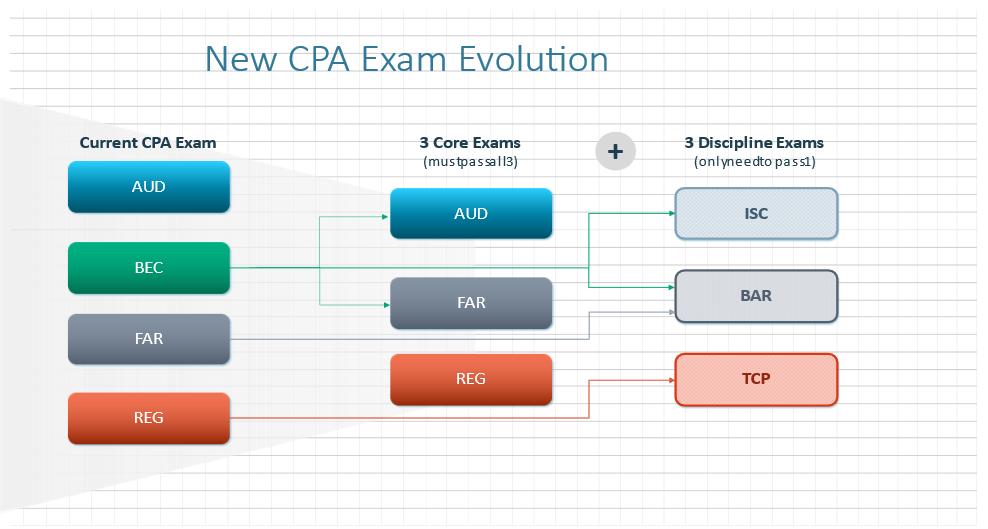

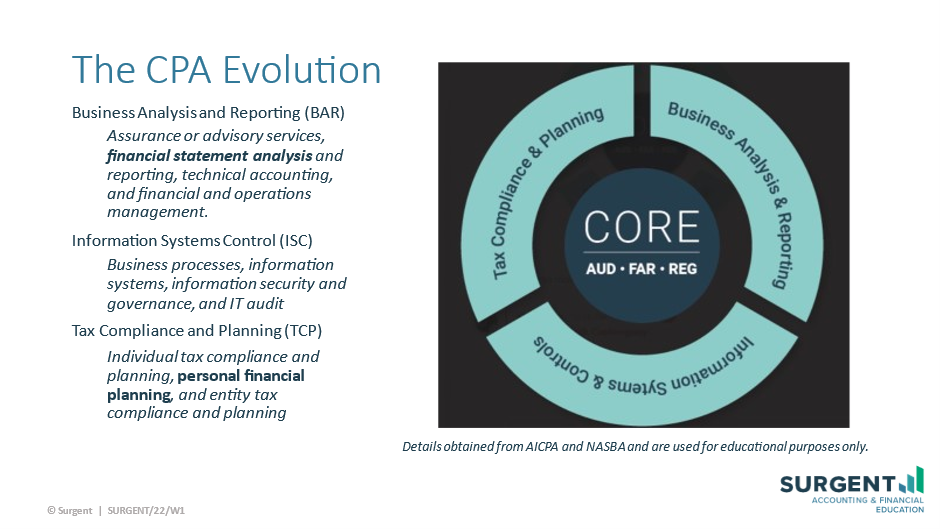

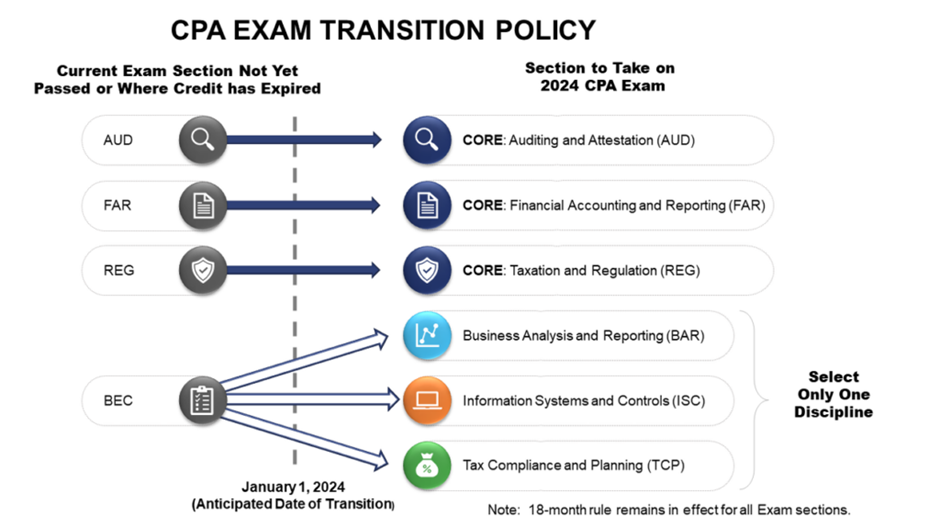

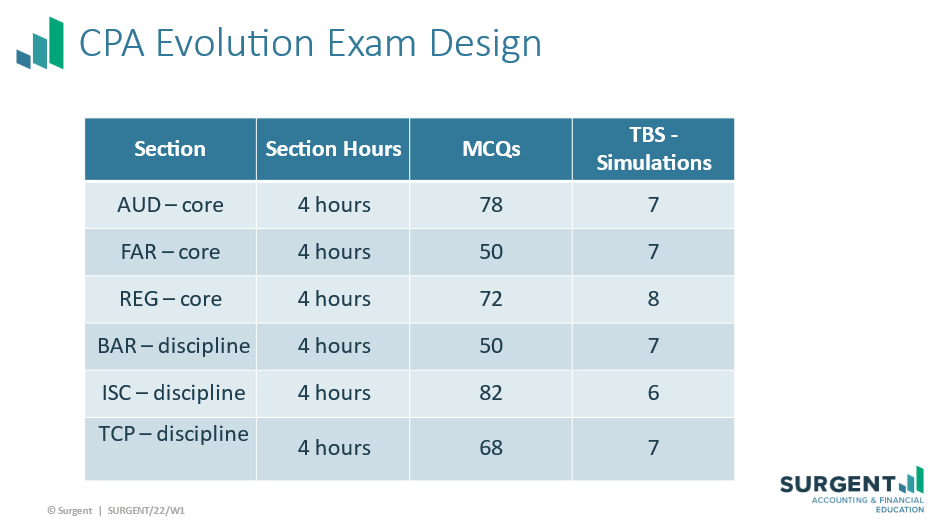

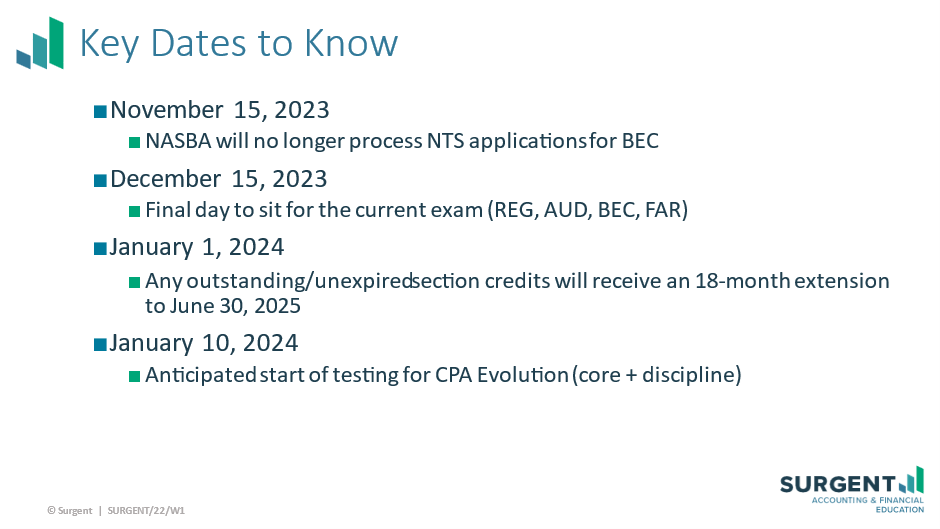

The 4-part exam of 4 hours each is online through prometric centers located in various Indian cities including the metros. After paying the exam fee and acceptance of application, the candidate will receive a Notice to Schedule (NTS) which is required to book the exam slot in the prometric. The 4 papers Of US CPA exam are as follows:

- Auditing and attestation (AUD)

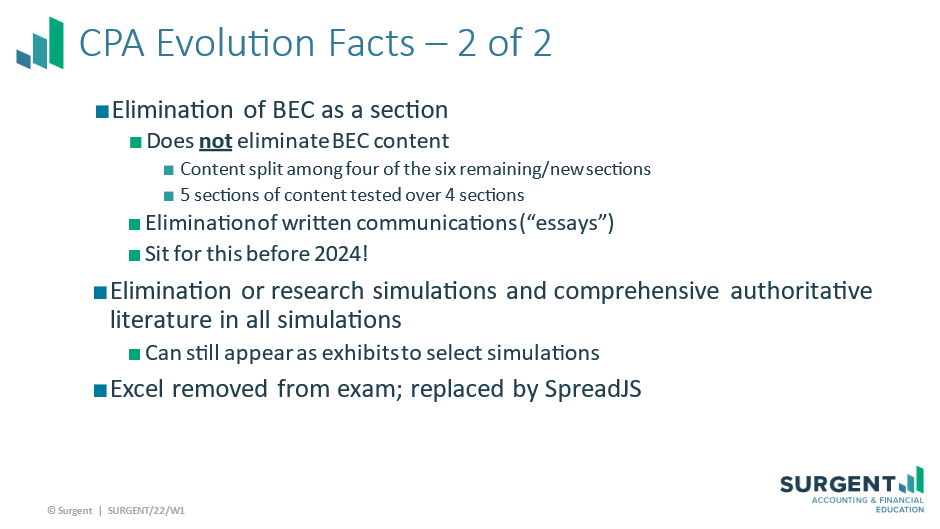

- Businesses environment and concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Regulation (REG).

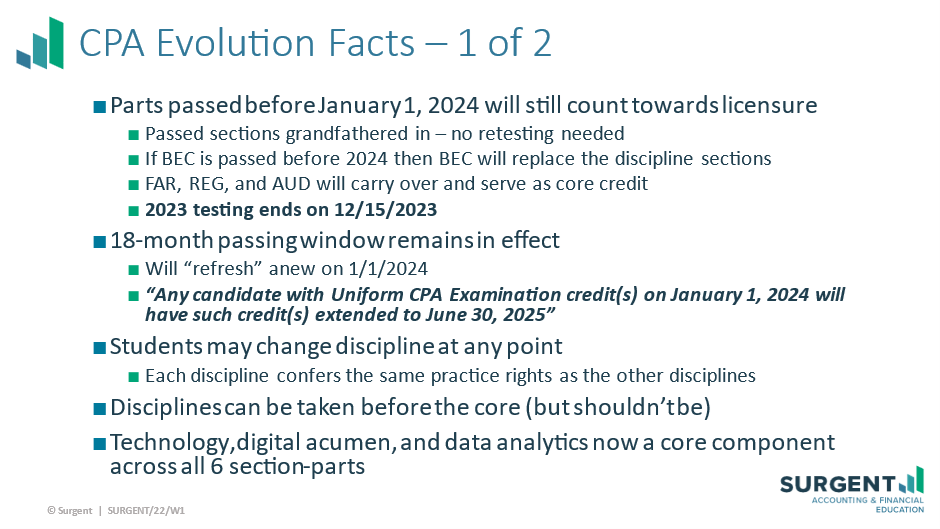

The pattern of the examination is divided into Multiple Choice Questions (MCQ), Task-Based Simulations (TBS) and one Written Component (WC). It is noteworthy that all four papers must be completed within a time period of 18 months.

Licensing of CPA

The requirements for CPA US licensing vary across the US states. However, having a 150 credit score is mandatory for most of the state bodies. In order to obtain the US CPA license, a candidate must fulfil the following:

- Clearing of AICPA Ethics exam

- Having the required work experience

- By paying the licensing fees.

ASPIRING CPA WITHOUT SOCIAL SECURITY NUMBER (SSN): IS THERE A WAY Out?

International CPA exam candidates often need to overcome several obstacles in order to get qualified for the exam. One such obstacle is the social security number (SSN). Rest assured that, in most cases, you can still sit for the CPA exam without the SSN.

What is Social Security Number?

A social security number is a 9-digit number issued to U.S. citizens, permanent residents, and temporary workers in order to track these individual for social security purposes. Regulated industries such as the CPA often require their licensees to submit the SSN to facilitate monitoring.

What about the Indian Students?

The AICPA has a helpful table showing the CPA exam requirements by state. Although almost all states ask for the social security number in the application form, a considerable number of them give special waivers to international CPA exam candidates or those who do not have the SSN, such as H4 visa holders.These candidates can submit an affidavit (as in Montana), or write a letter to the state board to explain the situation (as in Colorado). You can send a quick email to the respective state boards for clarification.

List of States which don’t require SSN

Alaska, Guam, Maine, Illinois, Michigan, Montana, New Mexico, New York, North Dakota, Northern Mariana Islands, Wisconsin.

Some Flexible States suitable for Indian Students

Illinois — Standard Exam Rules but Flexible Experience Requirement

Virginia: May Accept BCOM + CA; Your Supervisor/Verifier doesn’t Need to be a CPA

Guam: 150 Credit Hours + No Experience Needed if You Don’t Mind the Inactive License

Alaska: Can Sit Before Getting 120 Credit Hours

Washington: Experience can be Verified by Someone other than Your Boss

CPA Exam Cost:

The overall cost for an Indian student to pursue US CPA stands around 3.5-4 lakhs in average for the entire procedure including the administrative costs. In India, a candidate giving an examination of US CPA is required to spend approximately INR 2,00,000 without a training fee.

Scope of CPA US

The most preferred areas of US CPAs are auditing and taxation which are considered best and financially rewarding in both Indian and international context. A CPA US can work in various fields ranging from accounting, auditing, US taxation, consulting, etc. The average pay scale of a US CPA in India is 7 lacs approx. which increases with experience and type of employers. Apart from various Indian based MNCs, Big 4 companies like KPMG, PwC, Deloitte, EY, etc. have many US clients that require US CPA candidates for auditing, taxation purposes. In addition, Popular US-based companies like Apple, Amazon, Capgemini, Cognizant, etc. require US CPA candidates for US taxation, auditing etc.

Summary

CPA US is a very uplifting credential in the career growth of a finance guy. It is highly respected and recognized in the fraternity, and thus is not a soft cake to cut. No doubt, It helps in career development, gives career security, job satisfaction and various monetary benefits, but to achieve that, you need proper dedication and a mind set. Selecting the right jurisdiction/state board is of immense value. The SSN is typically not the bottleneck in the CPA exam qualification process. Candidates should instead look closely at the education and experience requirement first. but not the least, selecting a high-quality student friendly training institute like Uplift Pro helps a lot to achieve your dream CPA US credential at first attempt.

For further information/assistance, contact: https://www.upliftprofessionals.in/us-cpa-course