US CPA exam schedule-Dates, Testing windows, Steps to schedule exam in 2023 | Uplift Professionals

The Certified Public Accountant or CPA is a credential acquired by professionally skilled accountants across the globe. To attain this credential or license, candidates must qualify the unified CPA Exam and fulfil their state board’s educational and experience requirements.

As the US CPA Exam is held at different locations across the globe all year round, choosing a suitable schedule, date, and Prometric testing centre is of paramount importance.

Are you ready to schedule your US CPA Exam, but need to find out how to get started? Find out everything you need to know to schedule your Exam below!

1. The concerned organizations associated with Exam

1.1 NASBA

The full form is National Association of State Boards of Accountancy. You can find information and guidelines on their website. NASBA issues the candidate bulletin, which helps you with test readiness and also issues your CPA score release.

1.2 AICPA

It stands for American Institute of Certified Public Accountants. The AICPA provides exam info and study materials. You can find a lot of answers to common questions on their website. They also publish pass rates.

1.3 Prometric

This organization facilitates the CPA examination. You will register for and reserve a seat at a Prometric test centre to take the exam.

There are four parts to the exam, and each one is taken separately. You must pass all four sections within 18 months. Some sections, like FAR (Financial Accounting and Reporting), are harder than others, so give yourself enough time between your exam dates to study.

2022 is a unique year for the US CPA Exam. The COVID-19 pandemic has changed the CPA test dates significantly. As of July 1, 2020, the regular testing schedule for the CPA changed. The AICPA made the test available year-round, replacing the four testing windows.

Candidates are able to register for testing throughout the year. A candidate schedules the Exam through Prometric while pays the fees to and receives the Notice to Schedule (NTS) from either the State Board of Accountancy/Agent or NASBA, depending on the provisions of the jurisdiction.

2. US CPA exam in India

Previously, to appear in US CPA exam in India, an Indian candidate had to travel abroad due to non availability of CPA test centers in India. However, this scenario has been changed after CPA testing centers started operating in India, a boon for the Indian CPA US course aspirants as it saves a lot of money incurred on travel and lodging to take the exam outside India.

Indian candidates to write the US CPA exam in India throughout the year from the following 8 Prometric centers :

1. Ahmedabad

2. Bangalore

3. Calcutta

4. Chennai

5. Hyderabad

6. Mumbai

7. New Delhi

8. Trivandrum

US CPA Exam 2022 – New Updates In 2020, the US CPA exam in India had few changes; the most prominent change was the introduction of the CARES Act to the REG section effective in Q4 2020. In 2021, the Exam will undergo additional changes, mainly to the AUD & BEC sections, with minor revisions to the remaining two sections – FAR & REG….continue reading

3. How to determine if you’re eligible to sit for the US CPA exam?

Before you start the process of scheduling US CPA Exam, you’ll want to determine if you’re eligible to sit. All CPA US course candidates who want to schedule their test, must ensure they have met all of their state’s educational requirements to sit for the exam prior to registration.

Note: Some states only require 120 semester hours to sit for the CPA Exam versus other states that require 150 semester hours.

4.How to apply to sit for exam?

Once the educational requirements are met to sit for the US CPA Exam, it’s time to apply to sit for the CPA Exam by visiting the National Association of State Boards of Accountancy (NASBA) to complete all CPA Exam-related tasks.

Note: If you are sitting for the examination in a provisionary state, you may be able to sit for the test a few months before completing all education requirements.

5. When you’ll receive your approval to sit for exam

5.1 Once you’ve met the educational requirements to sit for the US CPA Exam, chosen the jurisdiction from NASBA Website, where you’ll sit for the CPA Exam and receive approval to take the US CPA Exam. This approval is called the Authorization to Test (ATT). The ATT allows you to choose the CPA Exam section(s) you want to take.

5.2 Once you pay the required fees to NASBA for the sections you’re taking, you’ll receive a Notice to Schedule (NTS) via email.

5.3 Once you receive your NTS, you’ll need to sign into your account on the NASBA Website and print your NTS. The NTS indicates which sections of the exam you’re approved to take.

6. When you should schedule your US CPA exam?

There are a couple of ways to decide when to schedule your test. Since the examination is offered throughout the year, it’s easy to find a time that fits your study schedule. However, it’s important to not wait until the last minute to schedule your test.

The Prometric testing centres typically fill up on certain, popular, dates. So, try to schedule your assessment at least a month before you want to sit for the CPA Exam so you’re ensured you have a seat. Deciding when to schedule your US CPA Exam should be determined on a couple of factors.

If you’re motivated by a “testing date,” then scheduling your US CPA Exam early and working towards that date might keep you motivated to stay on track. If you tend to procrastinate, then it might be better to schedule your test further out so you have time to really study prior to sitting for the assessment. Another option is to study for the exam first, then schedule the exam.

7. Steps to schedule your US CPA exam:

1. Submit your CPA exam application and fees

Your application will be approved by your respective state board of accountancy or NASBA (as some states contract NASBA to process applications), using NASBA’s CPA Central.

2. Receive your Authorization to Test (ATT) in the mail

Once your ATT is received, you have 90 days to pick which CPA exam section(s) to sit for and when. Once you decide, you will then register and pay your exam fees on the NASBA website.

Note: Some states will send your ATT directly to NASBA, so be aware of this as your 90 days to choose your section(s) will have begun.

3. Verify the information on your Notice to Schedule (NTS)

Between three and six weeks later, you’ll receive your Notice to Schedule (NTS), which allows you to sit for a section of the CPA exam in the United States or at an international testing centre.

4. Schedule your CPA exam section

Now, you can schedule a testing date and time with a Prometric testing center. But know that your NTS is valid for six months only (in most states, see below for exceptions to this rule), so don’t wait to make your plans or risk paying more exam fees.

| Exam date (on or before) | Targeted score release |

| 23-Jul | 10-Aug |

| 15-Aug | 24-Aug |

| 7-Sep | 15-Sep |

| 30-Sep | 12-Oct |

| 23-Oct | 9-Nov |

| 15-Nov | 23-Nov |

| 8-Dec | 16-Dec |

| 31-Dec | 11-Jan |

5. Exceptions to the six-month NTS window include:

a. Texas (90 days)

b. California, Hawaii, Louisiana, and Utah (9 months)

c. Virginia (12 months)

6. The estimated CPA exam score release dates from the AICPA for 2022:

Because the BEC section may require manual scoring on written tasks, CPA exam takers in the earlier part of the year may have experienced delays.

8. How to Schedule Your CPA Exam at a Prometric Testing Centre

The CPA Exam is administered by Prometric Testing Centres, open year-round, 6 days a week, with locations across the U.S. You’ll visit Prometric.com to schedule your US CPA Exam

Prior to visiting the Prometric Website, be sure to have available:

1. Your NTS for eligibility verification

2. A primary photo identification

3. Personal calendar for choosing the date, time, and location to sit for the CPA Exam.

Things you can accomplish on the Prometric Website:

1.Schedule your CPA Exam

2. Locate a Prometric test centre

3. Reschedule your CPA Exam

4. Cancel your CPA Exam

5. Confirm your CPA Exam test date

Once you’ve determined which section to take first, it is recommended that you sit for that part of the exam immediately after studying for that same section. For example, study for FAR and then take FAR, and so on.

8. Steps to schedule your CPA Exam as an International candidate

Note: A Passport is required to test for the CPA Exam at an international location

1. Apply to sit for the CPA Exam through a State Board of Accountancy that participates in international testing. Visit the NASBA Website for more information.

2. When you receive your Notice to Schedule, you are then able to schedule your CPA Exam. The NASBA Website provides information on which jurisdictions allow for international testing. If you don’t see your jurisdiction on the NASBA Website, then that means you cannot take the CPA Exam internationally through that jurisdiction.

3. If your jurisdiction allows international testing, then you’ll pay the international fees and complete your international registration. You will be asked to provide identifying information, as well as information from your NTS.

Note: After you’ve completed the registration process for each CPA Exam section, you’ll need to wait 24 hours before you are able to schedule your Exam. Once you’re ready to schedule your CPA Exam, choose the location where you want to take the CPA Exam.

4. Choose, “Schedule an Exam.”

5. Be sure to review and agree to the policy information before proceeding.

6. You’ll enter your CPA Exam section ID number from your NTS and then enter the first four letters of your last name and choose the bottom right arrow to move ahead.

Note: It’s important to properly confirm your CPA Exam section before moving onto the next section. Also make sure you put in the correct CPA Exam section ID for each section before moving ahead in scheduling.

7. Choose your location, date and time and then choose “Complete Registration.”

9. Accept data privacy notice

While scheduling the examination, candidates would come across the Data Privacy Notice. They must accept the terms and conditions of the same. At Prometric, the data entered by candidates while registering and scheduling the examination are stored in the central U.S. database. This privacy policy guarantees the protection to all the data stored, confirming no sharing of information with third parties.

10. Important CPA Exam Score Release Information

The AICPA wants you to know the following about your CPA Exam score release date:

All dates and times are based on the Eastern Standard Time (EST) zone. Furthermore, both domestic and international candidates receive their scores according to the same score release timeline. However, international candidates may experience a one-day delay due to extra processing and validation.

For most candidates, Prometric sends exam data files to the AICPA within 24 hours after you complete your exam section. The scores from any exam data files the AICPA receives from Prometric after the AICPA cut-off dates will be released in subsequent scheduled target score release dates.

11. How to check CPA Exam scores

Of course, on the CPA Exam score release day, the most important question is, “How can I check my CPA score?” Well, your US CPA Exam results may come from 1 of 2 sources.

First, your state board of accountancy may utilize NASBA’s online score retrieval service. If so, you can visit NASBA’s website on the CPA Exam score release day to get your score (aka the NASBA Candidate Portal). Not all state boards use this service, so you must check with your state board to determine if they do. You should also consult your state board for answers to any of your other score release questions.

Second, your state board may handle the score release process themselves. In that case, you will receive your exam score from them. Your state board may post the scores on their website and then email you when you have the opportunity to find your score there. Or, your state board may mail your scores to you in a physical letter.

Some larger state boards, such as the California Board of Accountancy (CBA) or the Maryland Board of Accountancy, post scores in the accounts their candidates have for their online exam systems. Additionally, the IL Board of Accountancy also does not utilize the NASBA Candidate Portal for score releases.

Again, check with your state board of accountancy soon so you know exactly where to find your CPA test results on the CPA test score release day. When you sit for BEC, you might receive your score approximately 1 week following the target release date. This delay is the result of the additional analysis written communication tasks sometimes require. If you pass the test, you’ll receive a score notice that states your score, your credit status, and the date on which your credit earned for any passed section will expire.

In contrast, if you failed the test, you’ll receive a performance report. In this report, you’ll see your performance on each content area, as well as by Item Type. You’ll find your score notice and performance report in the NASBA Candidate Portal within 72 hours of receiving your score.

If you earned less than a 75 on the exam and a CPA Performance Report is generated, you’ll be compared to candidates who have just passed the exam.

The AICPA defines just passed as a candidate who earns a score between 75 and 80. What’s more, you’ll receive separate high-level information about your performance on MCQs, written communications (BEC only), and TBSs.

12. US CPA Passing Score

A passing score for any and all test sections is 75. This number is a scaled score. Therefore, it does not represent the percentage of questions you got right. Your test score can range from 0 to 99. Also, the AICPA does not curve exam scores.

The AICPA Board of Examiners (BOE) establishes the assessment passing score. To do so, they consider many factors such as standard-setting study results, historical trends, and exam content changes. They also receive input from NASBA, consultant psychometricians, the academic community, and licensed CPAs.

Then, the AICPA measures your test performance against these pre-established standards. Additionally, they hold every candidate to these same standards.

For AUD, FAR, and REG, your score is the weighted combination of scaled scores from the multiple-choice questions (MCQs) and task-based simulations (TBSs). For BEC, your total score also includes the scaled score of the written communications (WCs).

13. CPA Exam question scoring weight

| Question Type | AUD | BEC | FAR | REG |

| Multiple-choice questions (MCQs) | 50% | 50% | 50% | 50% |

| Task-based simulations (TBSs) | 50% | 35% | 50% | 50% |

| Written communications (WCs) | n/a | 15% | n/a | n/a |

Additional CPA exam notes

The timing for your test is an important element in your timeline for becoming a CPA. If you don’t schedule correctly, your study could either be rushed or prolonged. It’s important that you get all of the details in order, as there are several steps you’ll take, each of which could require some waiting.

14. Here are some things to keep in mind that could impact your schedule

· Be sure you’ve received your NTS before scheduling

· Remember, you interact with a few different organizations and websites during this process. After your application is submitted to the State Board of Accountancy, they will review documents to confirm your eligibility.

· Once they accept your application, they notify NASBA. That is when you receive your official Notice to Schedule (NTS).

· Until you have your NTS, you should not schedule the assessment. If a delay occurs, you could be bumped off of the schedule or have your plans change unexpectedly.

15. 18-month rolling window

Don’t forget that you have 18 months to take and pass all four sections of the CPA exam. You can’t miss this time limit. You may take the sections in any order and space them however you want, but you can’t exceed that time limit. If you do, you will be forced to reschedule and retake the exam sections.

16. What section of the CPA Exam should you schedule first?

One of the most common questions candidates have when deciding to register for the test is: in what order should I take the CPA assessment ? Choosing between the four assessment sections differs by individual and by how the exam content can change each year. Consider how much content you’ll need to learn when deciding which order to take the CPA exam. In general, when considering which part of the CPA exam to take first, most people choose to do the FAR test or AUD test as their first or second choices.

17.You’re now ready to start your CPA Exam journey!

Last but not the least, you need good quality mentoring from a suitable training institute to crack the test at one go. Uplift Professionals, is a premier training institute for test providing online classes powered by reputed and time tested Gleim CPA review materials.

US CPA salary in India ? In India a fresh CPA starts with a minimum salary of INR 6 Lakh annually in a Big4 or MNC. The salary increases at higher rate compared to non-certified peers. Meanwhile, a CFO can earn more than INR 1 Cr annually.

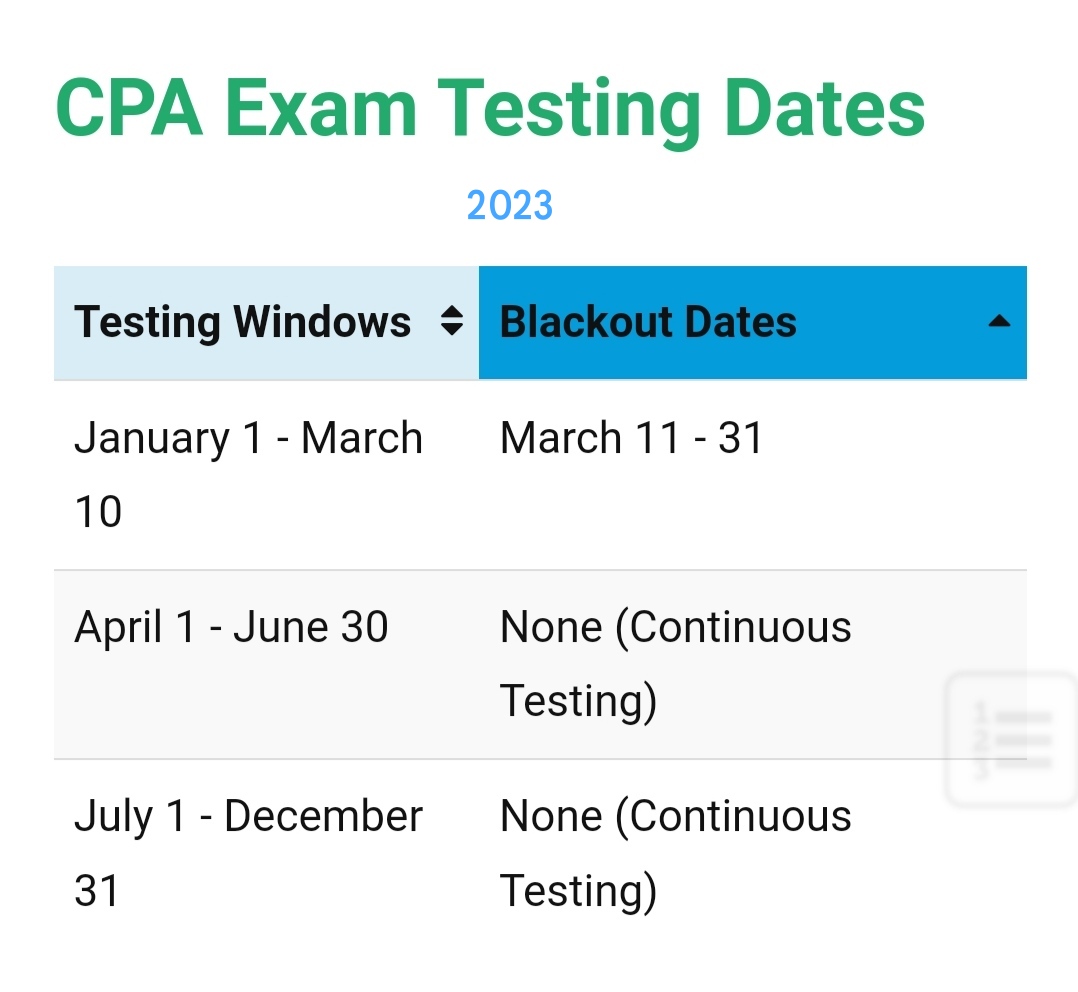

18. CPA Exam Testing Date 2023:

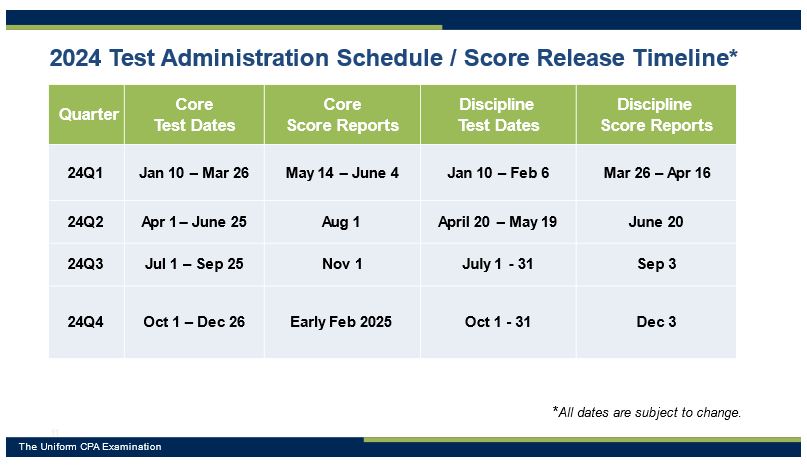

19. CPA Exam: 2024 Test Administration Schedule/Score Release Timeline:

20. CPA Exam Result Date 2023:

21. Summary

By going through the above information, now you might be quite well acquainted with the steps involved for scheduling your CPA exam in 2020. As you make plans to study for the CPA, you should schedule the CPA exam, figure out the dates you want to take the test, and make sure you give yourself enough time. Remember, you interact with a few different organizations and websites during this process. After your application is submitted to the State Board of Accountancy, they will review documents to confirm your eligibility. Until you have your NTS, you should not schedule the CPA exam. If a delay occurs, you could be bumped off of the schedule or have your plans change unexpectedly. Take the exam head on with the right CPA prep.

About the top CPA US Course training institute in India, Africa, and Middle East – Uplift Pro

Uplift Pro is one of the top training institutes for the US CPA, US CMA, US CIA, Enrolled Agent US, ACCA UK courses in India, Africa, and Middle East. Our team consists of seasoned professionals and entrepreneurs from IIEST, IITs, London Business School, and ULCA who have decided to provide a strong backup to young ambitious students and professionals to reach their desired career destinations in an organized way.

Uplift Pro, is an authorized partner of Gleim in India, provides you with authentic Gleim materials, updates and Live Online Interactive Classes for CPA US by internationally experienced veteran mentors. All at an Indian Cost.

Some of our exclusive features include –

A. Affordable US CPA course fees

B. CPA certified veteran TEAM of faculties

C. Live online classes ensuring that the regular office working hours is least impacted. Moreover, they provides class recordings.

D. 1:1 personal support from our 30 plus years of experienced CPA certified faculties ensuring that all our students pass the US CPA course

E. “Till you pass” guarantee assuring that students can attend our live online classes at no extra cost until you pass

F. Premium study materials with practice questions bank enabling students to pass the US CPA exam in India and rest of the world

G. Administrative guidance on US CPA evaluation procedure

H. Placement assistance

Request for Live Demo class / contact at +91-8787088850 to book your seats now.