How to surmount the US CPA exam- the integral steps |Uplift Pro

The unified US CPA exam conducted by AICPA is the gateway to achieve the hallmark in public accounting in a global perspective. What it ratiocinate is that a CPA certification makes one to be qualified exceeding all others in the career path in accounting and finance fields. Considering the importance of the US CPA exam, one can chalk out an effective study plan to clear the CPA exam.

Strategic steps to pass the US CPA exam

1. To Know the Exam Format

The US CPA exam is divided into following 4 sections which are designed to make the candidate knowledgeable and equipped to handle the responsibility of an accountant.

a. Financial Accounting and Reporting(FAR)

It is the most elaborate part of the US CPA exam having focus on general accounting like filling various cost and account transfers. This section demands specific knowledge in general concepts related to finance. The duration of exam for this section is 4 hours with a 15 min allowable break exclusive of the stipulated 4 hours. Equal weightage is given to both MCQs and task based simulation questions where 12 MCQs and 1 simulation is considered pretested and not been counted in gradation.

b. Regulation(REG)

This is the second largest section and covers different facets of taxes and business law in encyclopedic attribute. The exam duration is similar to FAR where a 50:50 pattern is used to allocate grades based on MCQs and simulations respectively.

c. Auditing and Attestation(AUD)

In comparison to the above sections, this part is relatively shorter but considered to be most difficult by a majority of CPA US course aspirants. It comprises of different aspects of auditing and attestation in all-inclusive manner. The duration and gradation of this section is identical to the above mentioned sections.

d. Business Environment and Concepts(BEC)

This is the shortest section in the US CPA exam that covers general business concepts other than general accounting areas. Along with the MCQs and simulations, this section also contain essay questions. Having similar exam duration, the weightage given here is MCQs (50%), simulations(35%) and essay questions(15%) respectively.

2. US CPA exam preparation

To crack the US CPA exam, one has to give full mental dedications with an all-out study mode. It is being advisable to have a study plan of 300-400 credit hours approximately. Considering the regular work plan and commitments, this can be divisible in to something like 3-4 months for each section resulting in a total study time of around 1 year to clear the US CPA exam.

3. Knowing the State wise requirements for US CPA exam

Since some variations exist in the basic requirements to be eligible for US CPA exam, a prior knowledge about this and selection of appropriate state to enroll for helps the study process accordingly.

4. CPA exam Processing

This include submission of application, arrangement and forwarding of transcripts, payment of exam fees and obtaining a Notice to Schedule(NTS). Based on above, finally to schedule the exam in the nearest prometric centers.

5. Knowing to Schedule the Exam

Being a complex exam having diverse variables, one should be cautious when scheduling the CPA exam. Instead of an exact grade, CPA exam score functions more as a percentile. So the question is will you take all 4 sections in one go?. The expert advice is not to sign up for all 4 sections in a row irrespective of your confidence level. It is always advantageous to sign up for 2 sections at a time to effectively tackle the CPA exam.

Last but not the least, for US CPA exam, one should take advantage of a quality review/study material. This can be further supplemented by taking coaching from a premier CPA training institute.

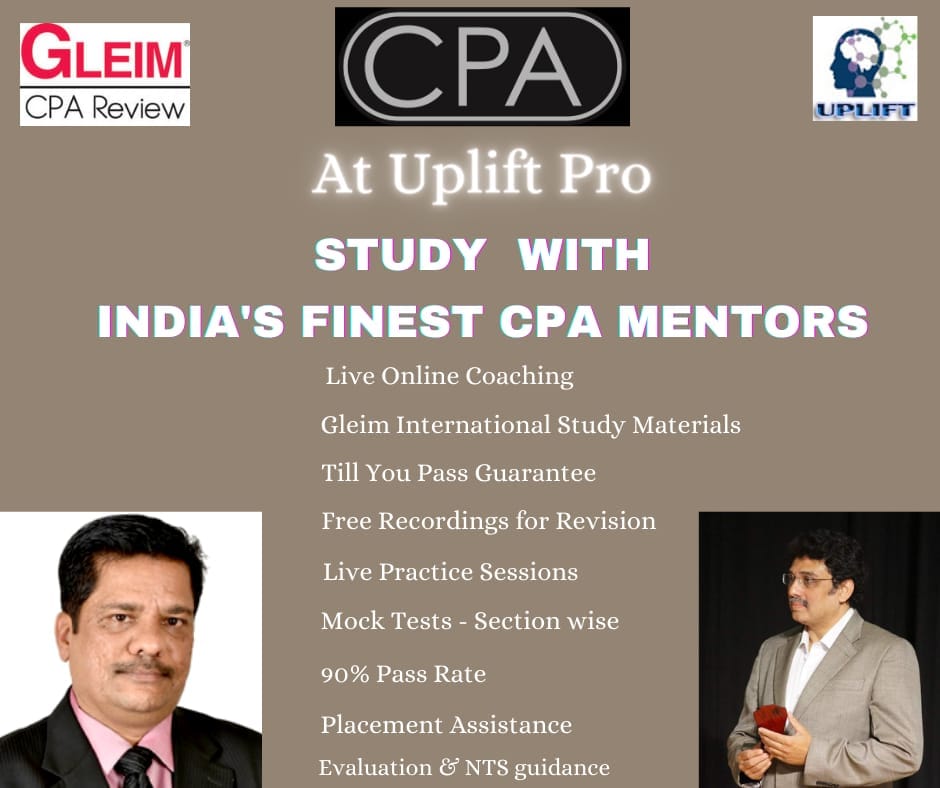

About the top US CPA training institute in India, Africa, and Middle East – Uplift Pro

Uplift Pro is one of the top training institutes for the US CIA, US CMA, CPA US in India, Africa, and Middle East. Our team consists of seasoned professionals and entrepreneurs from IIEST, IITs, London Business School, and ULCA who have decided to provide a strong backup to young ambitious students and professionals to reach their desired career destinations in an organized way.

Uplift Pro, is an authorized partner of Gleim in India, provides you with authentic Gleim materials, updates and Live Online Interactive Classes for CPA US by internationally experienced veteran mentors. All at an Indian Cost.

Some of our exclusive features include –

A. Affordable US CPA course fees

B. CPA certified veteran TEAM of faculties

C. Live online classes ensuring that the regular office working hours is least impacted. Also, provides class recordings to students.

D. 1:1 personal support from our 30 plus years of experienced CPA certified faculties ensuring that all our students pass the US CPA course

E. “Till you pass” guarantee assuring that you may attend our live online classes at no extra cost until you pass

F. Premium study materials with practice questions bank enabling students to pass the US CPA exam in India and rest of the world

G. Administrative guidance on US CPA evaluation procedure

H. Placement assistance

Request for Live Demo class / contact at +91-8787088850 to book your seats now.