CPA Evolution-The Forthcoming changes in Examination and Licensing Pattern | Uplift Professionals

The CPA credential is considered the coveted highest order of professional accounting skill globally. To make it more future relevant, the National Association of State Boards of Accountancy (NASBA) and the American Institute of Certified Public Accountants (AICPA) has jointly initiated a make over process on the exam and licensing pattern involving CPA exam and licensing procedures with effect from January 2024.

It is basically targeted towards inducting upskilled greater knowledge of emerging technologies. Since this effort is going to make a big leap from the existing pattern it is very much likely to be designated as an evolution in the CPA curriculum. It is of utmost importance to know this transition policy for a CPA aspirant who is going to start the CPA journey on or after January 1, 2024.

In the advent of the technological boom, the accounting profession also has to cope with the emerging technologies. Keeping this in mind, both NASBA and AICPA are restructuring the CPA exam and licensing procedures known as the CPA evolution. However, the 18-month duration remains unchanged.

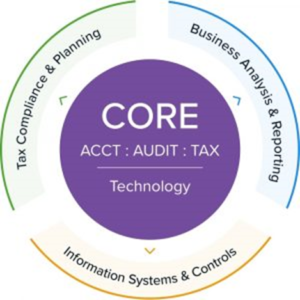

The new forthcoming CPA licensure and CPA Exam pattern is being considered as an amalgamation of 3 core and one discipline subject. The core subjects involve accounting, auditing, and tax that are mandatory for all candidates. Apart from the core, each candidate has to select a Discipline section for depiction of greater skills and knowledge. Furthermore, competence in knowledge and skills of technology will be tested throughout all sections. In any case, irrespective of the discipline chosen, there will be no obstacle to get a full CPA license. It has to be kept in mind that whichever the discipline chosen for the exam, it has no impact on the practicing right of a CPA.

The Transition

2024 CPA Exam Evolution: Core-Plus-Discipline Model in Detail

The new CPA exam and licensure system demand CPA candidates to have greater skill in the core subjects which have integrated questions from technology. Additionally, in depth knowledge is required in any of the following primary disciplines:

· Business Analysis and Reporting (BAR) – part of the Accounting core;

· Information Systems and Controls (ISC) – part of the Auditing core,

· Tax Compliance and Planning (TCP) – part of the Tax core.

It is mandatory for a CPA candidate to pass all three core sections and one discipline section on the CPA Exam. Candidates selecting one particular discipline will not be able to sit for another. It is noteworthy that the discipline passed has nothing to do with the type of license granted and obviously results in one CPA license irrespective of the discipline chosen.

(Source: NASBA)

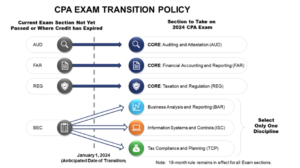

The Boards of Accountancy have nodded this transition policy as at present, since it serves the candidates better. The transition policy states that candidates having credit for AUD, FAR or REG on the current CPA Exam will not need to take the corresponding new core section of AUD, FAR or REG on the 2024 CPA Exam. Candidates who have credit for BEC on the current CPA Exam will not need to take any of the three discipline sections.

In case, a candidate loses credit for AUD, FAR or REG after December 31, 2023, they then must take the corresponding new Core section of AUD, FAR or REG. A candidate who loses credit for BEC after December 31, 2023, must select one of the three Discipline sections to be tested. It is to be noted that none of the sections of the current CPA Exam will be available for testing after December 31, 2023. There is a tough shedding from the present CPA Exam sections to the proposed 2024 CPA Exam sections on the January 2024 float.

Transition Policy for Each Section

(Source:NASBA)

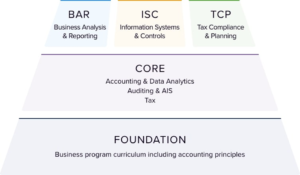

CPA Exam CORE Overview

It is presumed that CPA candidates who are going to write the 2024 CPA exam upon successful completion of a foundational scholastic program targeting a strong business and accounting-based curriculum. This will help a candidate to acquire the skills they require to practice in the present business scenario and be able to meet public demands.

Business Analysis and Reporting

CPA Candidates who are interested in assurance or advisory services, financial statement analysis and reporting, technical accounting, and financial and operations management should consider the BAR discipline. The content in the BAR discipline includes a data analytics focus and assesses topics like financial risk management and financial planning techniques. BAR could also include more advanced technical accounting and reporting topics, including assessment of revenue recognition and leases, business combinations, derivatives and hedge accounting, as well as employee benefit plan financial statements.

Information Systems and Controls

Technology and business controls is a focus of the ISC discipline. CPA candidates who are interested in assurance or advisory services related to business processes, information systems, information security and governance, and IT audits are encouraged to choose this discipline. Content for this discipline is focused on IT and data governance, internal control testing, and information system security, including network security, software access, and endpoint security.

Tax Compliance and Planning

The focus of the TCP discipline includes taxation topics involving more advanced individual and entity tax compliance. Content focused on personal financial planning and entity planning, inclusions and exclusions to gross income, and gift taxation compliance and planning could also be covered. Coverage of advanced entity tax compliance might include consolidated tax returns, multi jurisdictional tax issues, and transactions between an entity and its owners. The tax treatments of the formation and liquidation of business entities could also be included in entity planning.

Application of 2023 CPA credits to the new Core + Discipline model

It is to be noted that BEC credits will not count towards the core requirement but will go to the discipline requirement. However, one can select which of the three disciplines to apply for BEC credits. The options available are: Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP). For other sections, the road map is as follows:

• AUD credits will be applied to your core requirement of Auditing and Attestation

• FAR credits will count for the core Financial Accounting and Reporting requirement

• REG credits will transition toward the new requirement for Taxation and Regulation

Additionally, NASBA has clearly stated that despite the transition, “the 18-month rule remains in effect for all exam sections.”

sections (AUD, BEC, FAR, and REG) loosely translate to “new” sections. Furthermore, some old sections (AUD, FAR, and REG) align with the new “core” requirement of the Core + Discipline model, while BEC is more related to the “discipline” requirement.To put it another way, here’s how:

One CPA License

Although there are options to select from three different disciplines in the Core-Plus-Discipline-Model, there will be only one unified CPA license without any reflection of the specified discipline. The exam is supposed to remain in the four-section, 16-hour format. On the other hand, since the new 2024 CPA Exam will consist of three core sections and three discipline sections to opt from, candidates will have to pass all three core sections and one specified discipline section to obtain the CPA license.

The Impact

This CPA evolution will not have any impact on those candidates who passed all four sections of CPA exam before the end of 2023 and there will also be no impact on licensure. However, this transition policy will be going to affect those who are in the middle of their CPA journey. For example, if you pass one, two, or three sections before the end of 2023 and plan to pass the fourth in 2024, then you have to check about how the CPA Evolution will affect you; no exceptions will be given. Mind that, you won’t lose your credits, as long as you’re still inside your 18-month rolling window and you follow the path outlined by NASBA and the AICPA.

When are the 2024 CPA Exam Changes Expected to Launch?

NASBA and the AICPA intend to update the CPA Exam with the new core-plus-discipline model by January 2024. As of right now, students will take the new exam starting on January 1, 2024. The 18-month rule remains in effect for all exam sections.

Preparing for Professional Accounting Exams like the CMA, CPA, CIA in tough times : If you have been preparing for a professional accounting exam like the CPA examination or the CMA US examination at this time, you need to introduce some changes in your lifestyle and thought process so that you can focus properly. Read more…

Summary

Basically, the CPA Evolution initiative means that the CPA Exam will change by January 2024. And since you will need to demonstrate your skills in the core content areas plus a sub-discipline, the CPA Exam could become much more challenging. Technology continues to be increasingly vital to the accounting profession. Therefore, technology will be tested on the 2024 CPA Exam, not as a single discipline but throughout all exam sections.

“The proposed changes by the AICPA and NASBA are new and somewhat still vague at this point. However, like any profession, accounting must continue to evolve and adapt to our changing business and technological advancements. We have no doubt that CPAs will still maintain their critical role in the trustworthiness of our financial reporting and that the new CPA specialty exams will make CPAs even stronger in their subject field of choice. These changes will solidify the CPA’s role in continuing to serve the public interest in the 21st century.”—Gleim Publications, Inc.

The CPA Evolution will undoubtedly change which content educators teach, how new content is combined with legacy content and the prevalence of digital acumen and technology content across the curriculum. Educators and faculty can begin making changes to curriculum now to prepare for the new exam in 2024. Bite-sized introductions and self-paced projects will be the most beneficial until the final blueprint is released.

To get yourself “2024 CPA Ready”, contact: www.upliftprofessionals.in/CPA